Calculate stock roi

The Only Preconstruction Platform Youll Need. Lets get started today.

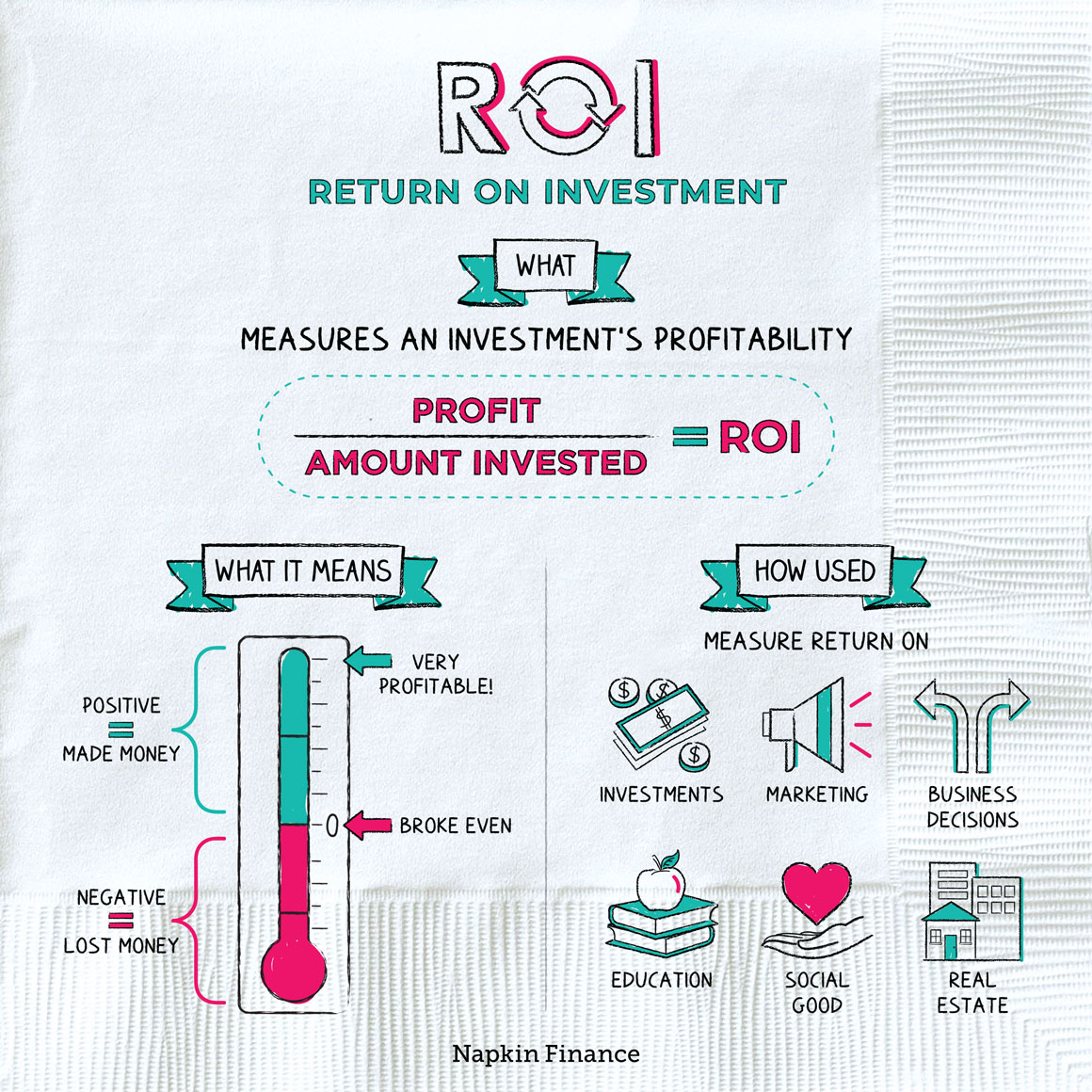

Return On Investment Roi Definition Equation How To Calculate It

The Stock Calculator is very simple to use.

. Whether youre considering getting started with investing or youre already a seasoned investor an investment calculator can help you figure out how to meet your goals. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Ad Win More Profitable Work with STACK Takeoff Estimating Software.

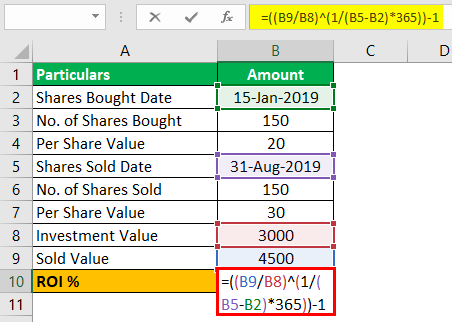

Enter the number of shares purchased. Looking at the annualized figures helps ensure youre making an. Heres the formula.

Multiply the result by. Total commission paid to buy the shares. Return on investment is a.

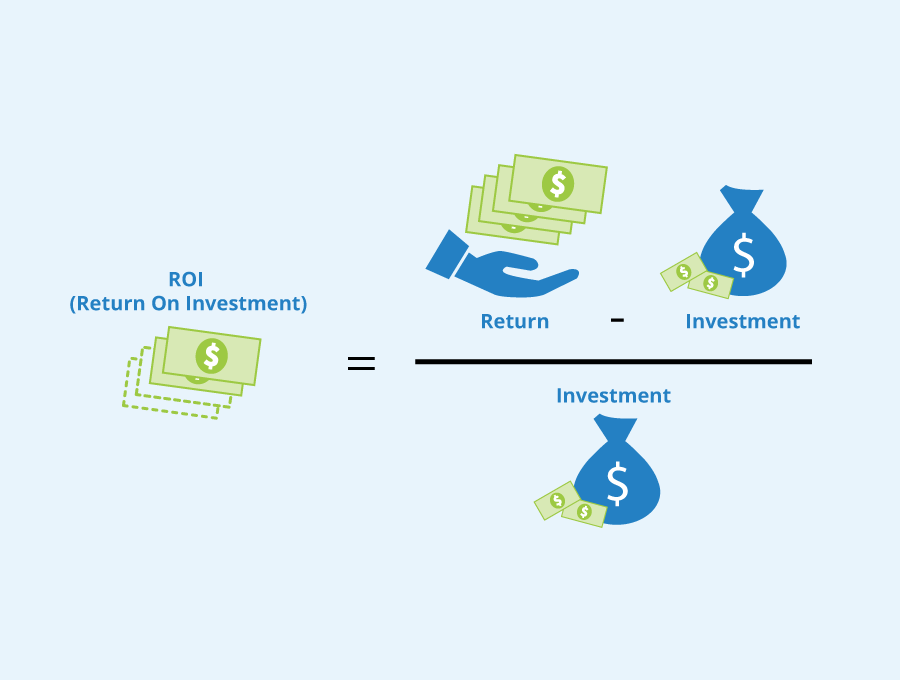

ROI return on investment. Current or ending value - Initial or starting value Dividends - Fees Initial Value. Create Your Free Account Today.

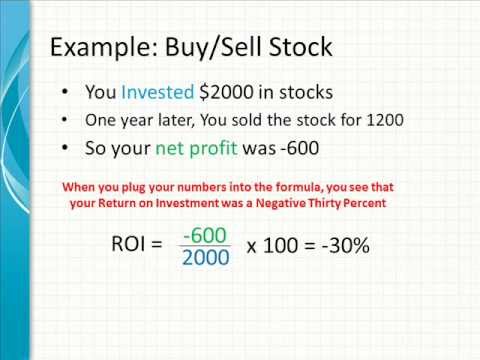

Lets say the index was at 4500 when you bought shares of a related index fund and at 4650 when you sold your shares. The formula for return on investment is. The final value of.

ROI GI - CI CI 100. Net fv net final value. Ad Experience a whole new of managing your FedEx and UPS Agreement.

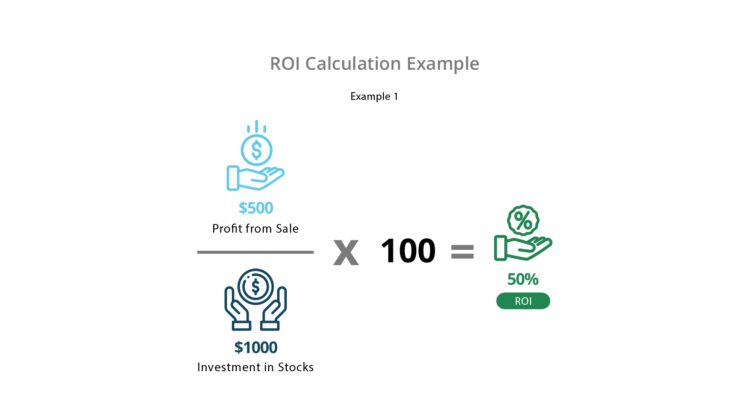

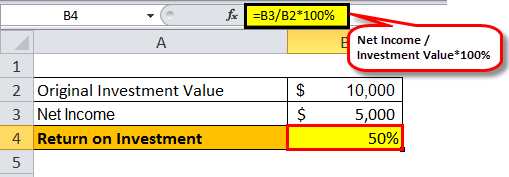

The first year you earn 100. The basic formula for calculating ROI is as follows. How to Calculate Return on Investment ROI.

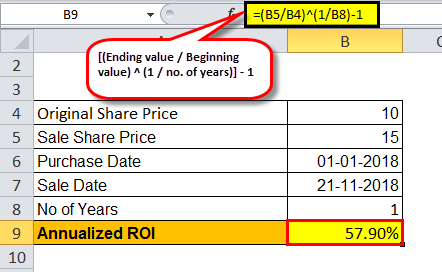

Where GI is the gain from investment CI is the cost of. Annualized ROI 1 ROI1n - 1 X 100. These two investments are risk-free cash flows are guaranteed and the cash flows are 500 for Investment A and 400 for Investment B next year.

Adding the 092 in dividends you received shows a total return of 382 per share on your investment. Second to convert this total return to a percentage you need to divide. For instance if stock Y generates an ROI of around 50 for 5 years of holding period and stock Z returns 30 over a span of 3 years You can quickly determine which.

Return Profit BP NS BC For example if you purchased 100 shares at 085 per share paying 10 in purchase commissions and later sold. ROI net fv - iv iv 100. Heres an example using the SP 500 Index.

In this article we explain what ROI is how to calculate it when to use it and the benefits of calculating your return on investment. Heres how that can work. How to calculate ROI for a project.

ROI net profit. Enter the purchase price per share the selling price per share. A portfolios return on investment ROI can be calculated as follows.

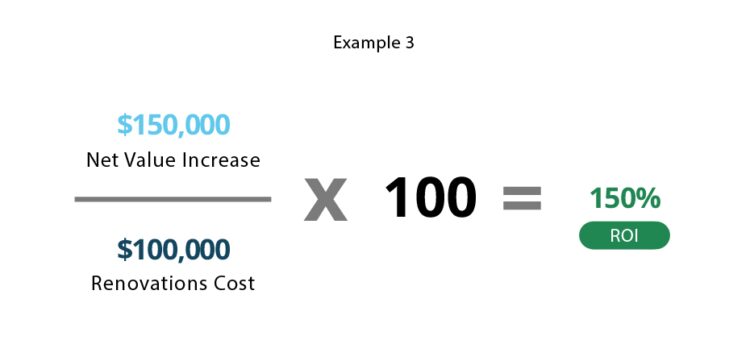

To calculate your ROI divide the net profit from your investment by the investments initial cost then multiply the total by 100 to get a percentage. Return on Investment Formula Example. Now that the fundamentals are out of the way lets look at how you calculate ROI.

Weve got your freight covered Real Time Visibility Scorecard Management. Just follow the 5 easy steps below. It can show you.

Take stock of project details. Ad Were all about helping you get more from your money. But the next year you earn 110 to.

Say you have 1000 to invest and you expect to earn 10 returns on it each year. N number of years the investment is held.

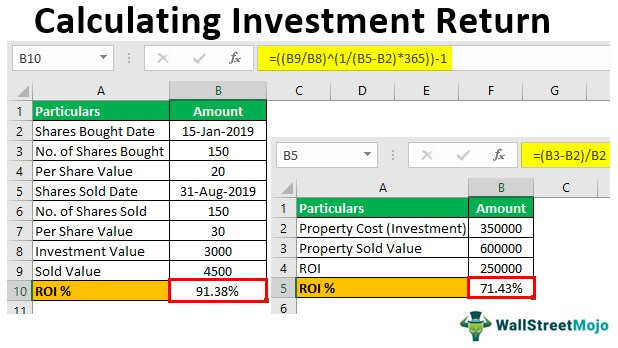

Calculating Investment Return In Excel Step By Step Examples

Return On Investment Roi Formula Meaning Investinganswers

Return On Investment Roi Formula Meaning Investinganswers

Roi Formula Calculate Roi And More From Napkin Finance

Return On Investment Definition Formula Roi Calculation

Return On Investment Definition Formula Roi Calculation

Calculating Return On Investment Roi In Excel

How To Calculate Roi Youtube

Calculating Return On Investment Roi In Excel

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

Calculating Return On Investment Roi In Excel

What Is Roi And How Do You Calculate It Seobility Wiki

Stock Total Return And Dividend Calculator

Return On Investment Roi Definition Equation How To Calculate It

Calculating Investment Return In Excel Step By Step Examples

Return On Investment Definition Formula Roi Calculation

.jpg)

Return On Investment Roi Formula Meaning Investinganswers